In August 2016, the FAA approved the usage of drones for commercial use. Often, these unmanned aircraft systems (UAS), are used in areas that are difficult or dangerous for people to inspect, such as condemned buildings, new construction, damaged roofs and collapsed buildings.

Many of our home inspectors fly drones over private or controlled-access property only with the permission of the owner or authorized party. Without permission/consent, it is illegal for any drones to fly within the zone. Therefore, the inspectors and insurance companies need to have permission from all landowners they fly over.

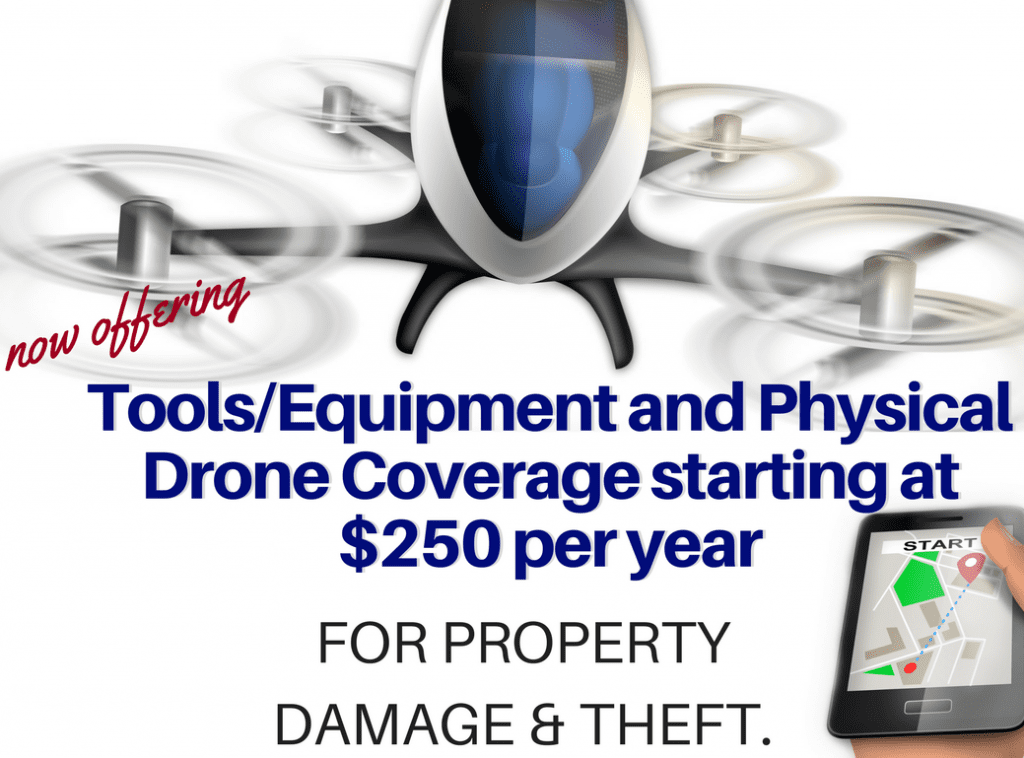

Protect your home inspection business and your drone with unmanned aircraft systems insurance. Request a quote from EliteMGA for UAS insurance.

Make sure you get tools and equipment coverage for your home inspection business! EliteMGA, LLC offers drone coverage UAS insurance for your physical drones used for business purposes.